The Shifting Landscape of Global Business

Imagine a world map of business power from just 30 years ago. The bright spots would have been concentrated in North America, Europe, and Japan. Look at that same map today, and you’ll see new stars rising – emerging economies that are reshaping how global business operates. At the center of this transformation is India, whose story offers fascinating insights into how developing nations are changing the rules of international business.

India’s Remarkable Rise

The numbers tell a compelling story:

- Second highest real GDP growth (8.4%) globally after China (10.1%) during 2006-2010

- Ranked 9th globally for attracting foreign investment in 2009

- Received $34.6 billion in foreign direct investment in 2009

But what makes India’s case particularly interesting isn’t just the scale of investment – it’s the efficiency. For every $100 of fixed capital formation in India, $6.80 came from foreign investment during 2005-2009, outpacing even China’s $5.90. This suggests that foreign investors are finding India an increasingly attractive destination for their capital.

Three Key Trends Reshaping Global Business

- The Power Shift

- Emerging economies now receive over half of global foreign investment

- Developing countries are no longer just recipients but becoming major investors themselves

- Traditional power structures in global business are being rewritten

- India’s Dual Role

- As a Host: Attracting global companies seeking growth and innovation

- As an Investor: Indian companies increasingly buying assets abroad

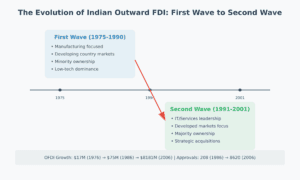

- Growth in outward investment: 119% annually during 2000-09 (compared to China’s 97%)

- The Innovation Factor

- India emerging as a hub for low-cost innovation

- Global companies establishing R&D centers

- Local companies becoming multinational players

Why This Matters

This transformation has implications for:

For Global Business:

- New markets for growth

- Access to talent pools

- Innovation opportunities

- Cost advantages

For India:

- Technology transfer

- Job creation

- Economic development

- Global competitiveness

For Other Emerging Economies:

- Model for development

- Lessons in economic liberalization

- Pathway to global integration

Key Areas of Focus in India’s FDI Story

- Inward Investment

- Role of non-equity partnerships

- Geographic distribution within India

- Challenges in natural resource projects

- Outward Investment

- Emergence of Indian multinationals

- Sector-specific trends

- Financing patterns

- Policy and Impact

- Technology transfer

- Local capability development

- Market competition effects

Looking Ahead

The story of foreign investment in India represents more than just financial flows – it’s about the fundamental transformation of a major economy and its ripple effects across the global business landscape. As one expert noted, “Understanding India’s experience is crucial for comprehending the future of global business.”

Practical Implications

For Business Leaders:

- Consider India both as a market and an innovation hub

- Understand various entry modes beyond traditional FDI

- Watch for emerging Indian competitors

For Policy Makers:

- Balance between attracting investment and domestic interests

- Focus on developing supportive infrastructure

- Promote technology transfer and local capability building

For Researchers:

- New patterns of global business emerging

- Complex interplay between domestic and foreign firms

- Evolution of business models in emerging markets

This transformation of India’s role in global business offers valuable lessons for other emerging economies and provides insights into the changing nature of international business in the 21st century.

Academic Abstract:

Karnataka is among pioneering Indian states to frame suitable policies aimed at encouraging local firms’ export activities. Promotion and facilitation of firms to look beyond national market was achieved by creating a strong enabling institutional framework, supporting expansion of productive capacity and helping exporting firms gain access to required physical infrastructure. As a result of such policies, exports from the Karnataka have been growing rapidly, with Karnataka contributing over half a quarter of Indian exports of commodities and software. The present study provides an overview of export trends and patterns of Karnataka in the backdrop of the state policy developments. It examines the relevance of various factors pertinent to the exports by Karnataka manufacturing firms and deduces implications for development policy of the state.

Learn More:

Full citation: Pradhan, Jaya Prakash (2011), ‘Foreign Direct Investment and Development in India’, Transnational Corporations Review, 3(2), pp. I–VI, Publisher: Routledge, Taylor & Francis.

Learn More: